Moody's Credit Rating

Equifax, Experian, and TransUnion are to a personal credit score as Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Global Ratings (“S&P”), and Fitch Ratings Inc. (“Fitch”) are to a school district credit rating. These institutions translate our complex life experiences into a more or less objective scale that then determines parts of our financial lives. A school district’s credit rating, similar to a personal credit score, is one of the most important determinants of borrowing costs and maybe a source of community pride.

Ratings in General – Bond ratings are designed as a service to the investment community. Many investors rely on ratings to support their internal credit and interest rate decisions as they contemplate buying bonds like the District’s. To provide some perspective on the highs and lows of the investment grade rating scale, the table linked below shows the investment grade ratings used by Moody’s, Fitch and S&P Global for Ohio’s schools, cities and other municipalities.

Credit Rating Scale: https://5il.co/3juq2

Milford was recently evaluated with a credit rating of Aa2 by Moody’s, which is considered “High Quality.”

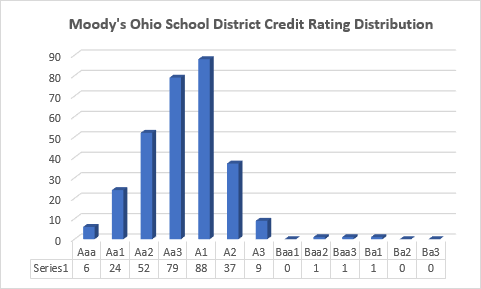

Of the 298 Ohio school districts currently rated by Moody’s, only 52 have an Aa2 rating. As a benchmark, just 30 districts rate higher than Milford—24 with a rating of Aa1 and 6 with the highest possible rating of Aaa.

Milford’s strong credit rating reflects key financial strengths, including high resident incomes, robust cash reserves, and a demonstrated commitment to fiscal responsibility. A higher credit rating allows the district to refinance bonds at lower interest rates, ultimately saving taxpayers money over time.